Losing a loved one is never easy and can be emotionally challenging for everyone involved. When an individual passes away, whether they have a will or not, their “estate” (all of the property that the deceased owned when they died) must be administered according to the laws of British Columbia.

Whether you’re an estate executor or an administrator, understanding the process of probating a will and the role of a personal representative is crucial to ensuring the estate is managed and distributed in accordance with the law and the wishes of the deceased.

This blog will outline the initial steps during the probate and the administration of an estate in BC and your duties as a personal representative of an estate.

Probating a Will or Applying for a Grant of Administration

Probate is a legal procedure where the BC Supreme Court validates a will and authorizes the executor to administer the estate. If you’re handling an estate, it’s essential to determine whether probate is necessary. If there is a will, the executor named in the will may apply to the court for a Grant of Probate.

If there is no will, a similar process may be followed to apply for Letters of Administration. In this case, the court will appoint an administrator, often a close relative of the deceased, to manage the estate. The administrator’s role is similar to that of an executor, involving securing the estate’s assets and eventually distributing them according to BC’s laws of intestacy.

Identifying a Personal Representative of an Estate

A personal representative of an estate plays a crucial role in managing and distributing the deceased’s assets while ensuring transparency and clarity for the estate beneficiaries. A personal representative includes an executor of a will or, if the deceased individual did not have a will, an administrator appointed by the court.

Normally, a will expressly appoints one or more estate executors. A will also may specify a person who will act as a substitute in case the person initially named as an executor is unable or unwilling to act. However, it is possible for an individual to fall into the position of personal representative even if the will does not expressly appoint them. If a will only implies an appointment based on the duties imposed on a person, probate would still be granted to that person as “executor according to the tenor of the will.”

As a personal representative, you carry the responsibility of ensuring the deceased’s wishes are honoured. Executors, named in the will, and administrators, appointed in cases without a will, have similar duties: securing assets, paying debts and taxes, and distributing the remainder of the estate. Your role is pivotal in the estate administration process.

As someone named as an estate executor in BC, it’s essential to understand that no one can compel you to take on this role unless you assume the duties and responsibilities associated with acting as an executor. Serving as an executor is a voluntary responsibility involving a significant time commitment.

You must be fully prepared to undertake the duties that come with the role and see the job through to the end. Your decision to assume the responsibility for the estate’s assets or the payment of its liabilities should consider your general readiness level and ability to allocate significant time to the estate resolution process.

If you wish to resign your position or decline to act at all, it is essential to make this known clearly and early because an executor can forfeit the option to decline their role by engaging in what is referred to as “intermeddling” with an estate. Intermeddling involves taking actions concerning the deceased’s assets that indicate an intent to assume the responsibilities typically associated with executorship, even if you do not intend to accept your appointment.

If you have been named executor and are still determining your willingness to proceed, we recommend that you refrain from taking any action until you’ve had the chance to consult with an experienced lawyer. Otherwise, you may be unable to resign.

If you accept your appointment, the Estate Administration team at Linmac LLP can guide you through the probating a will, helping you understand your duties and when to distribute assets to the beneficiaries.

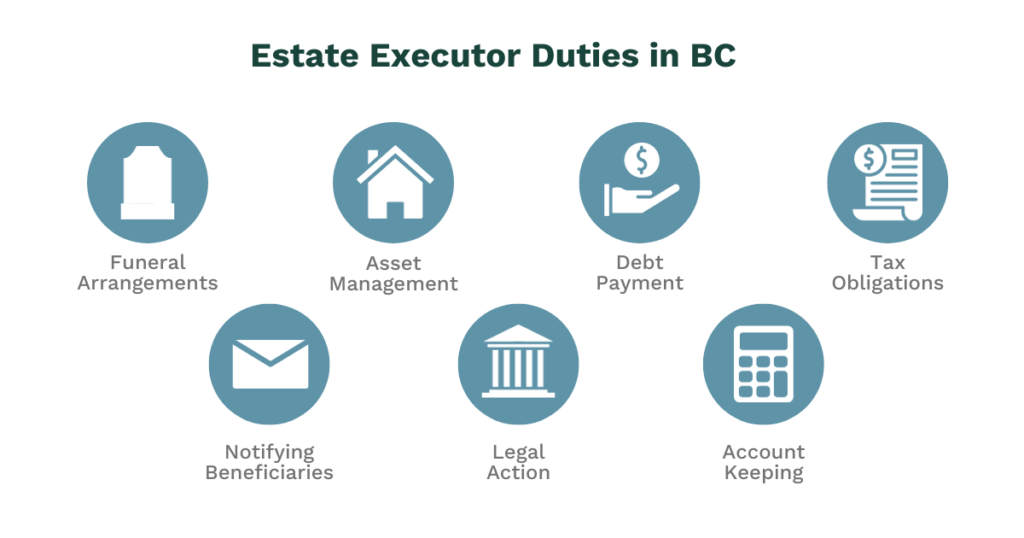

Understanding Estate Executor Duties in BC

When a court is probating a will, the court’s probate registry confirms the validity of the will and designates you, the estate executor, as the responsible party for estate administration. Various entities, including land registries, ICBC, and financial institutions, typically require a grant of probate before allowing you to manage and deal with any estate assets.

Your duties as an executor will vary, depending on the terms of a will. Still, most estate executor duties commonly include the following:

- Ensuring appropriate funeral arrangements are made.

- Taking possession or control of the deceased’s assets. This includes taking a detailed inventory of assets and liabilities and insuring any capital property against fire and other perils to the full value of the property.

- Paying debts and making provision for other liabilities.

- Liaising with the Canada Revenue Agency and settling all outstanding tax obligations.

- Notifying beneficiaries.

- Continuing or bringing and maintaining actions on behalf of the estate.

- Keeping proper accounts and being ready to account to the beneficiaries or creditors as applicable.

How a Probate Lawyer can help

Navigating the intricacies of probating a will can be a complex and emotionally taxing process, especially when the estate includes elements like shares in a private business, a diverse real estate portfolio, or intricate investment accounts. This is where the expertise of an estate administration lawyer becomes invaluable. With a professional at your side, you can ensure a smoother and more efficient handling of the estate, minimizing potential complications and stress.

At Linmac LLP, we recognize the complexity and emotional weight of managing complex estates. As a personal representative in BC, you’re faced with significant responsibilities, tax compliance duties, and legal intricacies. These challenges can be daunting, but with our firm’s support, they become manageable.

Our firm is committed to guiding and supporting you through this long and, at times, complicated process. Our goal is to ensure that you fulfill your duties efficiently and effectively. Understanding the laws and nuances of estate administration in BC is crucial, and our team specializes in providing comprehensive assistance through probate proceedings, estate management, and ensuring the fulfillment of an executor’s obligations. In addition, our team can offer a distinct advantage in aiding you with a range of post-mortem tax planning strategies where available.

We’re here to help, offering clear guidance and dedicated support every step of the way. Our expertise and experience will result in a smooth journey through the process.

Reach out to our team to learn about the next steps in your BC Estate Administration process.